Why Direct Relationships are Key for a Healthier Ad Tech Ecosystem

Published by Chris Maccaro on

Supply path optimization (SPO) has taken the ad industry by storm, with media buyers and agencies increasingly seeking the most efficient path to publisher inventory. This is for good reason, as the waterfall of supply chain intermediaries has had an adverse effect on data fidelity and transparency, while the ad tech tax has taken a toll on publisher revenues.

To help the industry make sense of it all, Jounce Media — the de facto source on all things SPO — continually publishes an SPO Fact Pack. Updated daily and free to use, this report quantifies the scale, directness, and reselling relationships of the largest real-time bidding (RTB) ad exchanges; leveraging insights that are informed by a crawl of over 100,000 ads.txt files and over 150 sellers.json files.

While the Fact Pack offers a wealth of insights on the state of SPO overall, we frequently find ourselves discussing the second piece — directness — with our clients and partners.

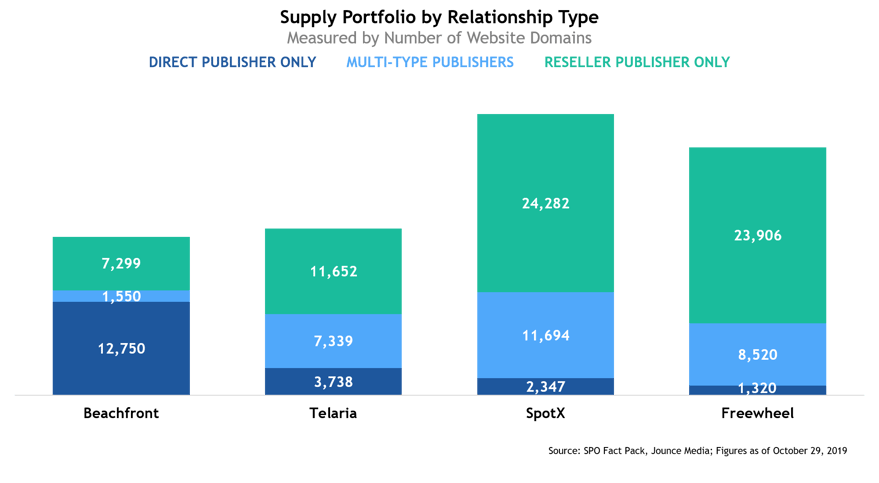

The data provided around directness shows the mix or percentage of direct, multi-type and reseller relationships among a given exchange or platform. To provide some additional context…

- Direct publisher relationships includes any instance where a digital publisher’s inventory is plugged directly into an ad exchange or platform, like Beachfront.

- Reseller relationships encompass any instance where a given publisher’s inventory is aggregated — along with inventory from other publishers — by a single vendor who then plugs all of the inventory into an exchange or platform.

- Lastly, multi-type relationships include a mix of both direct and reseller integrations.

Eager to dig in and illuminate the full supply chain, our media buying partners want to understand where their ad buys fall along these lines. They seek more direct paths to premium supply and are often frustrated with the lack of transparency that occurs as unnecessary intermediaries are introduced. Increasingly, they lose the ability to fight fraud, target advanced audiences at scale and reliably attribute ad performance.

On the flip side, publishers relinquish control in how and who their inventory is sold to as it moves through platforms and exchanges. With each added player in the supply chain, more publisher revenue is lost via the ad tech tax, squeezing margins and forcing difficult business decisions.

The data below, which is sourced from the Jounce Fact Pack, shows the supply portfolios of leading video ad management platforms across direct, multi-type and reseller relationships. The data, pulled from late October, reveals that Beachfront boasts the largest pool of direct publisher inventory among this set — and 3.4X, 5.4X and 9.7X more direct publisher scale than Telaria, SpotX and FreeWheel, respectively.

We are very proud to share this data, and of the work we’ve done to clean up fraud and establish ourselves a leader in direct publisher supply.

But we aren’t done yet.

Looking ahead, we know that SPO and market consolidation will continue. We also know that the ad tech tax (if left alone) will continue to siphon revenue from publishers and content creators who are increasingly subject to tighter margins and more competitive media environments.

Building an ecosystem with more direct relationships will effectively put more money in publisher pockets and create a more efficient, transparent path to premium supply for modern ad buyers. It’s a win-win for the industry as a whole, but we must remain diligent in fighting fraud, reducing the ad tech tax, and enabling more transparency.